ad_1]

The only technique to profit from a rising market is to purchase an index fund. However for those who purchase particular person shares, you are able to do each higher or worse than that. For instance, the Rackspace Know-how, Inc. (NASDAQ:RXT) share value is down 27% within the final 12 months. That contrasts poorly with the market return of 36%. Rackspace Know-how could have higher days forward, after all; we have solely checked out a one 12 months interval. It is down 31% in a couple of quarter. This might be associated to the latest monetary outcomes – you possibly can atone for the newest information by studying our company report.

Though the previous week has been extra reassuring for shareholders, they’re nonetheless within the pink during the last 12 months, so let’s have a look at if the underlying enterprise has been chargeable for the decline.

Check out our latest analysis for Rackspace Technology

As a result of Rackspace Know-how made a loss within the final twelve months, we predict the market might be extra focussed on income and income progress, not less than for now. Shareholders of unprofitable firms normally count on robust income progress. That is as a result of quick income progress could be simply extrapolated to forecast earnings, typically of appreciable measurement.

Within the final 12 months Rackspace Know-how noticed its income develop by 13%. That is not a really excessive progress price contemplating it would not make earnings. Given this pretty low income progress (and lack of earnings), it is not significantly stunning to see the inventory down 27% in a 12 months. It is vital to not lose sight of the truth that profitless firms should develop. So keep in mind, for those who purchase a profitless firm you then threat being a profitless investor.

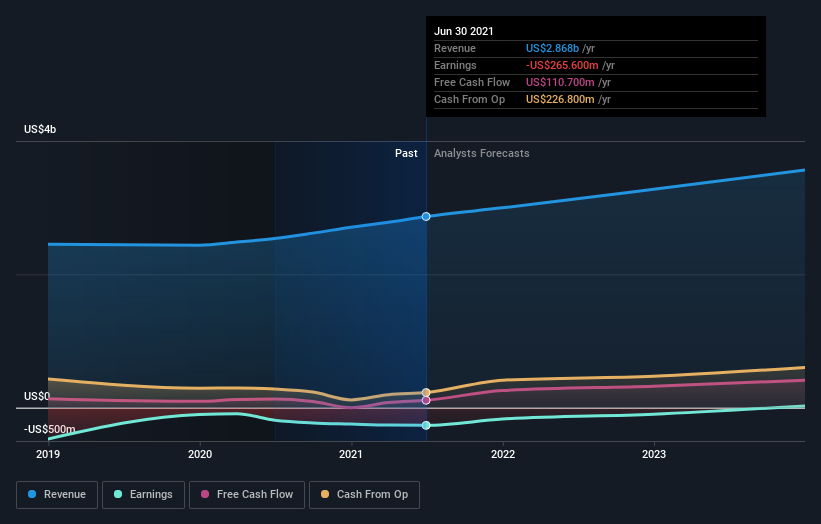

The graphic beneath depicts how earnings and income have modified over time (unveil the precise values by clicking on the picture).

We like that insiders have been shopping for shares within the final twelve months. Having stated that, most individuals take into account earnings and income progress developments to be a extra significant information to the enterprise. So we advocate trying out this free report showing consensus forecasts

A Completely different Perspective

Whereas Rackspace Know-how shareholders are down 27% for the 12 months, the market itself is up 36%. Whereas the purpose is to do higher than that, it is value recalling that even nice long-term investments generally underperform for a 12 months or extra. It is value noting that the final three months did the true injury, with a 31% decline. So it looks as if some holders have been dumping the inventory of late – and that is not bullish. I discover it very attention-grabbing to take a look at share value over the long run as a proxy for enterprise efficiency. However to actually acquire perception, we have to take into account different data, too. Contemplate for example, the ever-present spectre of funding threat. We’ve identified 4 warning signs with Rackspace Technology , and understanding them must be a part of your funding course of.

There are many different firms which have insiders shopping for up shares. You most likely do not need to miss this free list of growing companies that insiders are buying.

Please observe, the market returns quoted on this article mirror the market weighted common returns of shares that at present commerce on US exchanges.

When buying and selling Rackspace Know-how or some other funding, use the platform thought of by many to be the Skilled’s Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* buying and selling on shares, choices, futures, foreign exchange, bonds and funds worldwide from a single built-in account. Promoted

This text by Merely Wall St is normal in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We purpose to deliver you long-term centered evaluation pushed by elementary information. Notice that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

*Interactive Brokers Rated Lowest Value Dealer by StockBrokers.com Annual On-line Evaluate 2020

Have suggestions on this text? Involved concerning the content material? Get in touch with us immediately. Alternatively, electronic mail editorial-team (at) simplywallst.com.