One would assume {that a} proposal to restrict accumulations in Particular person Retirement Accounts (IRAs) wouldn’t be very controversial. The favorable tax provisions accorded retirement saving are designed to encourage rank and file employees to avoid wasting, to not make the wealthy richer.

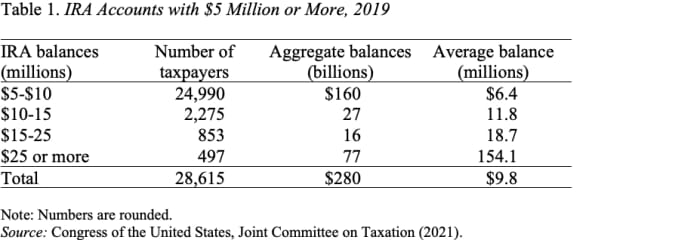

The web site Pro-Publica recently reported that billionaire Peter Thiel has a Roth IRA with a price of greater than $5 billion. The issue is that Peter Thiel and different entrepreneurs are capable of purchase numerous shares at a fraction of a penny per share and put them in an IRA the place they’ll develop in worth untaxed. And, according to the Joint Tax Committee, roughly 28,615 taxpayers have IRAs with greater than $5 million (see Desk 1). Collectively these accounts maintain $280 billion.

Read: How Peter Thiel turned $2,000 in a Roth IRA into $5,000.000.000

Not surprisingly, members of Congress are up in arms and wish to stop such abuses. Anthony Scaramucci, former White Home communications director, is just not shocked that Congress needs to take motion. He told CNBC: “A threshold will doubtless be imposed after a narrative like this, as a result of I believe the objective for these things was to assist middle-income folks have a nest egg for his or her future.” Introducing some threshold definitely feels like an inexpensive response to me.

However the headline of a current article by my good friend Mark Warshawsky cautioned: “If plans to chop IRAs succeed, the center class will likely be collateral injury.” His argument is {that a} well-paid police chief might simply obtain a good thing about $230,000 — the present IRS restrict — from a state or native pension plan. With post-retirement cost-of-living-adjustments and right this moment’s adverse actual pursuits charges, such a pension might be price $10 million. Therefore, the argument goes, inserting a $5-million cap on IRA balances for folks with all their retirement saving in an IRA would drawback them relative to the police chief.

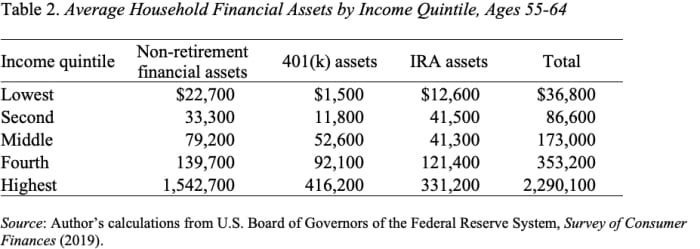

If Mark is arguing that the brink needs to be $10 million as an alternative of $5 million to make issues according to limits on different varieties of plans, that might be fantastic with me. Not that anyone has requested. However let’s be clear, neither threshold –$5 million or $10 million — has something to do with the “center class.”

Even for the highest quintile of the revenue distribution ages 55-64, the common of retirement and different monetary property is barely $2.3 million (see Desk 2).

The more durable concern is the best way to implement a brand new program that might stop additional abuse of IRAs. How concerning the following, assuming a $10 million threshold?

For brand new IRAs, Congress might ban all non-publicly traded shares from IRAs.

For present conventional IRAs:

- Lower than $10 million, contributions and appreciation might proceed.

- When account reaches $10 million, contributions should stop and any quantity over $10 million can be deemed a distribution and taxed as extraordinary revenue.

- For accounts already in extra of $10 million, any increment over their worth in 2021 can be deemed a distribution and taxed as extraordinary revenue.

For present Roth IRAs (the place contributions are made out of after-tax revenue):

- Lower than $10 million, contributions and appreciation might proceed.

- When account reaches $10 million, contributions should stop and any quantity over $10 million can be faraway from the IRA and would now not be eligible for tax-free appreciation.

- For accounts already in extra of $10 million, any increment over their worth in 2021 can be faraway from the IRA and would now not be eligible for tax-free appreciation.

Briefly, it’s actually annoying to see the tremendous rich exploit IRAs, and Congress ought to take motion.