ad_1]

With growing demand and harmful third-party dangers, cyber insurance coverage carriers are taking a a lot tougher take a look at enterprises’ safety postures — to the purpose the place they’re limiting or denying protection primarily based on the presence of sure applied sciences.

Cyber insurance premiums and payouts have risen considerably over the previous three years as assault surfaces and adversary methods have expanded. Insurance coverage carriers struggling to maintain tempo with the fast evolution of cybersecurity dangers have required clients to adjust to a rising checklist of necessities, resembling implementing multifactor authentication (MFA). However the prices of cyber assaults have climbed so sharply that cyber insurance coverage corporations are going a step additional.

Whereas work to enhance safety postures continues from either side, there are particular applied sciences and software program that may have an effect on protection for enterprises. Payal Chakravarty, head of product at cyber insurance coverage supplier Coalition, mentioned charges are primarily based on the basis causes that result in claims. Examples embrace remote desktop protocol (RDP), which continues to be an issue for SMBs, in addition to provide chain points and third-party accomplice dangers.

Whereas charges have elevated, she mentioned enterprises can management the prices by being extra clever about danger choice concerning the merchandise and applied sciences of their setting. Coalition charges are primarily based on sure applied sciences, which suggests it isn’t a flat fee improve for each renewal, in accordance with Chakravarty. Renewal charges are decided by a technology-based ranking and consumer conduct, together with how they responded to Coalition alerts and whether or not they fastened the problems.

For instance, Chakravarty mentioned the presence of SonicWall merchandise in a buyer’s community can result in increased premiums due to the variety of vulnerabilities and even zero-day flaws which were exploited by menace actors lately. Prices may be particularly excessive if a corporation fails to patch these vulnerabilities in a well timed method.

“You had SonicWall, [and] we all know SonicWall is a matter. We informed you to improve, and in case you aren’t doing it, we now have to cost you,” Chakravarty mentioned.

Flagged merchandise

Nathan Smolenski, head of cyber intelligence technique at Netskope and former CISO at Corvus Insurance coverage, mentioned that if rapidly a complete bunch of claims are available for a software program supplier, charges for utilizing that product will improve. This was highlighted in the course of the pandemic and a fast transfer to distant work that elevated the assault floor for adversaries. Menace actors more and more took benefit of misconfigurations and vulnerabilities in applied sciences resembling VPNs that enabled the work-from-home transition.

The ways in which corporations configured their staff to work remotely turned an enormous issue for cyber insurance coverage corporations, Smolenski mentioned. As a result of many corporations could not afford to purchase extra VPN licenses, they opened RDP as an alternative.

“The unhealthy guys go, ‘I can simply go online to Shodan and see all of the RDP periods which are out there and attempt to hack it,’ and that is free,” he mentioned. “That goes again to configuration, however vulnerabilities had been big too. We noticed in the course of the pandemic, it was like each month — Pulse Safe VPN, SonicWall, a unique one each month. And the cyber insurance coverage corporations checked out shoppers and mentioned, ‘You’ve gotten that downside, you want to repair it now.'”

Newer examples Chakravarty supplied included Kaseya, which suffered an assault final 12 months that affected managed service suppliers, in addition to NPM packages. In February, menace actors hid greater than 1,000 malicious JavaScript packages on the NPM Registry.

“[NPM] had no provisions for MFA, so that they had a large problem, and that had an influence on everybody — small, medium and enormous companies,” she mentioned. “Log4j impacts everybody, however from what we have noticed, it is primarily VMware Horizon [instances] we noticed claims from.”

In the case of merchandise with lots of vulnerabilities that carry excessive danger, Ismael Valenzuela, vp of menace analysis and intelligence at BlackBerry, cited Microsoft. When trying on the impact of buggy merchandise on cyber insurance coverage protection, he mentioned it is vital to take a look at the 2021 high exploited vulnerabilities.

“If we see that report from U.S. CERT, we’ll see numerous distributors within the checklist, however Microsoft’s vulnerabilities proceed to be prevalent and likewise essentially the most exploited in knowledge breaches,” Valenzuela mentioned.

Alternatively, Andreas Wuchner, area CISO at cybersecurity vendor Panaseer, mentioned it is community designs and configurations that can be flagged greater than merchandise, particularly in the case of the cloud. Insurers will increase architectural questions, resembling which containerization an organization is utilizing and in the event that they applied microsegmentation, he mentioned, somewhat than product questions.

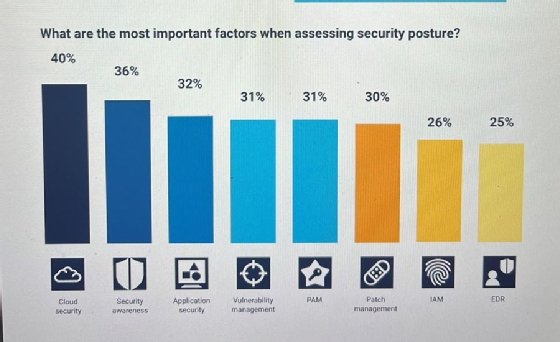

In its “2022 Cyber Insurance Market Trends Report,” Panaseer surveyed 400 insurers throughout the globe; respondents cited cloud safety as the highest issue when assessing safety postures due to the rising hybrid workforce.

The report additionally cited patch administration as an vital think about assessments. Wuchner mentioned most organizations are struggling to get sufficient time to patch the growing inflow of frequent vulnerabilities and exposures, and it does not eradicate different assault methods.

“It will be too straightforward guilty utility or legacy issues,” Wuchner mentioned. “There’ll at all times be a time when one thing is unpatched. There’s at all times an opportunity for a zero-day exploit or the opportunity of social engineering ransomware, the place folks click on on one thing.”

Dangers lengthen to everybody

At instances it seems enterprises rely too closely on cyber insurance coverage, somewhat than bettering their safety postures or enacting controls. For instance, infosec consultants say it performs a task in ransomware payments as a result of an organization is aware of it is going to be reimbursed if it provides in to the demand.

Now, the cyber insurance coverage market is shifting extra dangers to carriers.

Jennifer Rothstein, cyber insurance coverage and authorized professional at BlueVoyant, mentioned a brand new idea of co-insurance the place for a ransomware declare, the insured group might need to contribute out of pocket to any form of ransom fee or for investigations.

Rothstein additionally mentioned insurance coverage carriers are nonetheless grappling with how you can issue within the safety of a consumer’s third-party enterprise companions or distributors. Third-party dangers pose one of many greatest challenges for underwriting, and questions stay on how you can deal with it.

“The protection might or might not embrace their distributors, in order that’s one thing we’re making an attempt to determine,” she mentioned.

One other space that is sophisticated to insure is operational know-how (OT) and industrial management techniques (ICS) environments. Ian Bramson, world head of business cybersecurity for ABS Group, has noticed an elevated focus at first levels of cyber insurance coverage assessments. Initially, there was only a questionnaire to be stuffed out. Now, insurers count on senior administration to be current to undergo the sorts of questions in rather more element.

Nevertheless, he additionally mentioned most OT and ICS clients can not even reply the primary query: What do you want to defend? One other downside is that ICS or OT environments have legacy points as a result of the techniques had been designed to perform for many years. One instance Bramson cited was legacy wind generators, which may final 50 years, however weren’t designed with safety and software program patching in thoughts.

“The query is, do I pay some huge cash for my cyber insurance coverage to cowl very, little or no with numerous exceptions?” he mentioned.

Extra urgently, OT and ICS environments help essential infrastructures, so Bramson mentioned insurance coverage carriers have to think about greater than only a menace actor stealing confidential knowledge.

“Attacking OT could cause cyber-physical occasions which have a lot bigger impacts.” he mentioned. “The problem there may be, they do not have a great way to underwrite it.”