Key occasions

Filters BETA

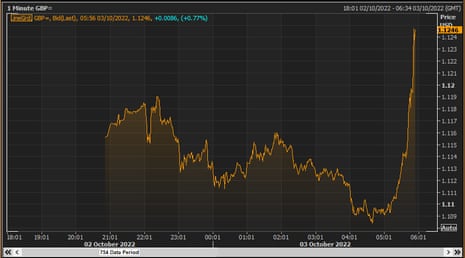

The pound has now recovered all its losses since Kwarteng’s mini-budget despatched it slumping to file lows every week in the past.

Sterling

Kwarteng scraps abolition of 45p prime tax fee

It’s official: the UK authorities is not going to go forward with its controversial plan to scrap the 45p prime fee of tax paid by h igh earners.

Chancellor Kwasi Kwarteng has introduced the u-turn on Twitter, declaring:

“We’re not continuing with the abolition of the 45p tax fee. We get it, and now we have listened.

Kwarteng says it has turn out to be clear that the plan has been ‘a distraction’ from the federal government’s mission to sort out the challenges dealing with the UK.

By abandoning it, he says the federal government can give attention to delivering the key components of its progress package deal.

Scrapping the abolition of the 45p prime finish tax fee is a ‘huge deal’ for the pound, says Viraj Patel, macro strategist at Vanda Analysis.

He predicts the pound might push greater this week, because the injury attributable to Kwasi Kwarteng’s mini-budget is unwound.

My estimates counsel $GBPUSD needs to be buying and selling round 1.13-1.14 if the complete ‘Kami-Kwasi funds’ danger premium is unwound. Appears affordable we get there within the subsequent few periods… 45p tax lower was the nail within the coffin for the pound final week. Taking this out is an enormous deal pic.twitter.com/LXwfCp3PWD

— Viraj Patel (@VPatelFX) October 3, 2022

Introduction: Sterling rallies on experiences of 45p tax fee u-turn

Good morning, and welcome to our rolling protection of enterprise, the world economic system and the monetary markets.

The pound is rallying this morning, on experiences that the UK authorities is making ready a screeching u-turn on its plan to abolish the 45p prime fee of revenue tax.

Sterling has jumped by as a lot as a cent to over $1.126 – its highest degree in over every week, only a week after it slumped to a file low round $1.035.

The restoration was sparked by experiences chancellor Kwasi Kwarteng might reverse the proposed scrapping of the 45p fee of revenue tax, simply 10 days after it was introduced within the mini-budget.

The U-turn comes after sturdy opposition from a number of Tory MPs, after the mini-budget precipitated chaos within the monetary markets final week amid issues that Britain was growing borrowing to fund tax cuts for the wealthy.

Final Friday, rankings company Customary & Poor’s cut the outlook for its AA credit standing for British sovereign debt to “unfavourable” from “steady”, judging that prime minister Liz Truss’s tax lower plans would trigger debt to maintain rising.

However it’s a exceptional twist; yesterday Truss mentioned she was absolutely committed to abolishing the 45% prime fee of tax.

Main U-turn by Truss & Kwarteng – deliberate scrapping of 45p prime fee of tax will NOT go forward

Markets react very positively; pound 1.17% in opposition to greenback in half an hour after U-turn introduced

— Jack Parker (@JackParkr) October 3, 2022

Our Politics Dwell blogger Andrew Sparrow experiences:

Solely yesterday Liz Truss informed the BBC’s Laura Kuenssberg that she was dedicated to sticking to the plan, introduced within the min-budget, to abolish the 45% prime fee of tax. Now the federal government is ready to ditch it – after it turned clear on the primary day of the Conservative celebration convention that Truss would face an enormous riot if she tried to power her MPs to vote for it.

The Solar’s political editor, Harry Cole, first broke the information of the U-turn final night time. He’s co-writting a biography of Truss, and is without doubt one of the journalists seen as being near her administration.

🚨🚨🚨

NEW: Liz Truss making ready to ditch 45p fee TODAY after late disaster talks with Chancellor

Humiliating climb down plan comes after day of acrimony on Brum

Announcement anticipated in morn in physique blow to new Authorities

No denial from No10 this eve https://t.co/He8qwMayou

— Harry Cole (@MrHarryCole) October 2, 2022

Andy is overlaying all of the motion from the Conservative Social gathering convention right here:

Additionally developing right now….

European inventory markets are set to begin the brand new month with contemporary losses, as recession fears mount.

Earlier right now, knowledge exhibits that Japan’s manufacturing exercise grew at its slowest tempo because the begin of final 12 months in September.

Japanese factories had been hit by a slide in output and new orders, because of weakening demand from China, the USA and different buying and selling companions.

Joe Hayes, senior economist at S&P International Market Intelligence, which compiles the survey, defined:

“Weak spot in Japan’s manufacturing sector continued in September and even turned worse.

That’s a nasty signal for demand within the international economic system.

We’ll additionally learn the way factories within the UK, eurozone and US fared final month, as worries concerning the international downturn deepen.

The agenda

-

9am BST: Eurozone manufacturing PMI report for September

-

9.30am BST: UK manufacturing PMI report for September

-

3pm BST: US manufacturing PMI report for September